I've ordered a fully loaded Chevy Bolt Premiere, which will arrive soon, and am in the process of getting initial lease numbers worked out with the dealer.

I have done some basic research, and do I believe I understand the details of how leases (mostly) work, but am new to the process and would welcome advice.

MSRP on this configuration is $43510. I don't believe that, currently, many dealers are willing to go below MSRP on the 2017 Bolt. This dealer has indicated the same, and I believe that is relatively consistent with other Bolt customers on this forum and other forums who have worked with other dealers in the past couple weeks.

So, I am (wisely or unwisely) considering MSRP as a probable given cost of doing business for being an early adopter on the Bolt.

That said, the first round of proposed lease numbers from the dealer intuitively feel high to me, and I'd love some advice as to (1) if that is true, (2) what if anything looks off, and (3) what is the best path forward.

Here are what I think are the relevant numbers. (Let me know if there's anything I am not posting here which would provide additional insight.)

MSRP $43510

Selling Price $43510 (Discount $0)

Gross Cap Cost $44185 (MSRP + Doc + Acquisition Fee)

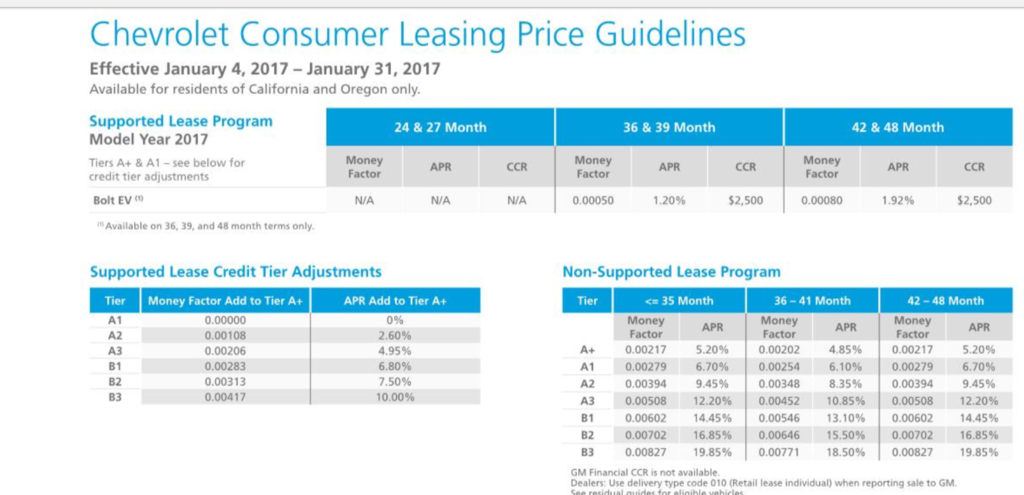

$2500 CCR from GM

$1073.89 of GM CCR applied Upfront (1 month advance payment + License Fee + ?)

$1426.11 of GM CCR applied as Cap Reduction

Net Cap Cost $42758.89

$0 Down from Customer

36 months

12k miles

59% residual

MF .000721

Monthly Payment (pre tax) $524.01

Monthly Payment (incl tax) $564.62

Any thoughts or constructive advice would be appreciated!

I have done some basic research, and do I believe I understand the details of how leases (mostly) work, but am new to the process and would welcome advice.

MSRP on this configuration is $43510. I don't believe that, currently, many dealers are willing to go below MSRP on the 2017 Bolt. This dealer has indicated the same, and I believe that is relatively consistent with other Bolt customers on this forum and other forums who have worked with other dealers in the past couple weeks.

So, I am (wisely or unwisely) considering MSRP as a probable given cost of doing business for being an early adopter on the Bolt.

That said, the first round of proposed lease numbers from the dealer intuitively feel high to me, and I'd love some advice as to (1) if that is true, (2) what if anything looks off, and (3) what is the best path forward.

Here are what I think are the relevant numbers. (Let me know if there's anything I am not posting here which would provide additional insight.)

MSRP $43510

Selling Price $43510 (Discount $0)

Gross Cap Cost $44185 (MSRP + Doc + Acquisition Fee)

$2500 CCR from GM

$1073.89 of GM CCR applied Upfront (1 month advance payment + License Fee + ?)

$1426.11 of GM CCR applied as Cap Reduction

Net Cap Cost $42758.89

$0 Down from Customer

36 months

12k miles

59% residual

MF .000721

Monthly Payment (pre tax) $524.01

Monthly Payment (incl tax) $564.62

Any thoughts or constructive advice would be appreciated!